CA OAH-1 2010-2024 free printable template

Show details

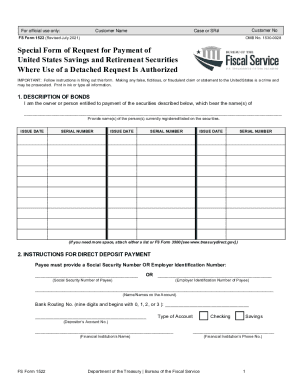

BEFORE THE OFFICE OF ADMINISTRATIVE HEARINGS In the Matter of Agency / Agency Case No. OAH No. SUBPOENA Requesting Testimony SUBPOENA DUCES TECUM THE PEOPLE OF THE STATE OF CALIFORNIA SEND GREETINGS TO 1. You are hereby commanded business and excuses being set aside to appear as a witness on date at time and then and there to testify at location OAH 2349 Gateway Oaks Drive Suite 200 Sacramento CA 95833 OAH 320 West Fourth Street Room 630 Los Angeles CA 90013 OAH 1515 Clay Street Suite 206...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your subpoena oah form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subpoena oah form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit subpoena oah form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit california state county form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

How to fill out subpoena oah form

How to fill out California state:

01

Gather all necessary documents such as identification, proof of residency, and any required forms.

02

Complete the required application forms, ensuring that all information is accurate and up to date.

03

Pay any required fees associated with the application process.

04

Submit the completed application forms and any supporting documents to the appropriate government agency or department.

05

Follow up on the application status and provide any additional information if requested.

Who needs California state:

01

Individuals who reside in California and wish to establish legal residency.

02

Non-US citizens who want to obtain a California state identification card or driver's license.

03

Individuals who need to register their vehicles or obtain a California license plate.

04

Business owners who want to register their businesses in California.

05

Students who want to attend college or university in California and need to establish residency for tuition purposes.

06

People who want to vote in California elections and participate in the democratic process.

07

Individuals applying for various government benefits and services in California.

08

Anyone who plans to live, work, or conduct business in California and needs to comply with the state's laws and regulations.

Video instructions and help with filling out and completing subpoena oah form

Instructions and Help about county los form

Fill subpoena you oah : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california state?

California is a state located on the West Coast of the United States. It is the most populous state in the country and is known for its diverse population, beautiful coastline, and vibrant economy. California is home to major cities such as Los Angeles, San Francisco, and San Diego. It is also known for its entertainment industry, technology sector, and agricultural production. California is often referred to as the "Golden State" and has a rich cultural, social, and political history.

Who is required to file california state?

California residents who meet certain income thresholds or who have other specific circumstances are required to file a California state tax return. These individuals include:

1. Individuals whose California gross income exceeds certain thresholds. For the 2020 tax year, the thresholds are as follows:

- Single or married/RDP (Registered Domestic Partner) filing separately: $18,235

- Head of household: $24,392

- Married/RDP filing jointly, qualifying widow(er): $36,470

2. Nonresidents or part-year residents of California who have income from California sources exceeding certain thresholds. For the 2020 tax year, the thresholds are as follows:

- Single or married/RDP filing separately: $9,168

- Head of household: $12,216

- Married/RDP filing jointly, qualifying widow(er): $18,336

3. Individuals who are required to file a federal tax return (regardless of income) and who are claiming the California Earned Income Tax Credit (CalEITC), the Young Child Tax Credit (YCTC), or the California Child and Dependent Care Expenses (CDCE) Credit.

These requirements can change, so it is advisable to consult the California Franchise Tax Board or a tax professional for the most up-to-date information.

How to fill out california state?

To fill out a California state form, such as a tax return or any other official document, you'll need to provide accurate and complete information. Here are the general steps to follow:

1. Gather Required Information: Collect all the relevant documents and information before starting. This may include personal details, financial records, identification documents, and any other supporting materials specific to the form you are filling out.

2. Read Instructions: Carefully read and understand the instructions provided with the form. Understand the purpose of the form, the sections you need to complete, and any special requirements or conditions.

3. Provide Personal Information: Begin by entering your personal information, including your full name, address, date of birth, and Social Security Number or taxpayer identification number as requested.

4. Complete Required Sections: Fill in each section of the form strictly following the instructions provided. Double-check all entries and ensure they are accurate, legible, and relevant to your situation.

5. Report Income and Deductions: If applicable, accurately report your income, including wages, interest, dividends, and any other sources of income. Deductible expenses and credits should also be carefully calculated and entered.

6. Attach Supporting Documents: Attach any necessary supporting documents, such as W-2 forms, 1099 statements, or receipts, as specified by the form's instructions. Ensure these attachments are organized and labeled appropriately.

7. Review and Verify: Review the completed form thoroughly to ensure all information is correct and complete. Verify calculations, signatures, and any other required elements. Mistakes or incomplete information can lead to delays or penalties.

8. Sign and Date: Sign and date the form where required. In some cases, additional signatures may be necessary from a spouse or a representative if applicable.

9. Make Copies: Before submitting the form, make copies of the completed document for your records. It's important to have a copy of the form for future reference or if needed by any other authorities or agencies.

10. Submit the Form: Send the completed form following the instructions provided, usually by mailing it to the appropriate address. Some forms may allow electronic submission, in which case you should follow the designated online process.

Remember, this is a general guideline, and the process may vary depending on the specific form you are filling out. It's always recommended to refer to the instructions provided with the form and seek professional advice if necessary.

What is the purpose of california state?

The purpose of the state of California is to serve its residents by providing governmental services and maintaining public order and welfare. This includes establishing and enforcing laws, promoting economic growth and development, providing education and healthcare, maintaining infrastructure, protecting the environment, and ensuring public safety. The state government is responsible for managing resources, collecting taxes, managing public lands, and representing the interests of Californians at the state level. Ultimately, the goal is to enhance the quality of life for its residents and promote the general well-being of its population.

What information must be reported on california state?

There is a wide range of information that must be reported in California state, depending on the specific context. Here are some examples of the information that may need to be reported:

1. Personal and demographic information: This includes details such as name, address, social security number, date of birth, gender, and other personal identifiers.

2. Employment information: Employers in California are required to report various details about their employees, such as wages, hours worked, and any deductions or benefits provided.

3. Taxes: Individuals and businesses in California must report income, deductions, and credits for tax purposes. This includes reporting state income tax, sales tax, property tax, and other applicable taxes.

4. Business information: Companies operating in California need to report information related to their business activities, such as business structures, registrations, permits, licenses, and financial statements.

5. Education information: Educational institutions need to report information on students, faculty, curriculum, performance, and other educational data as required by the state's education department.

6. Health and safety information: Various industries and organizations may be required to report health and safety data, incidents, injuries, illnesses, and compliance with regulations.

7. Environmental information: Entities dealing with hazardous materials, pollution control, waste management, and other environmental areas may need to report information on their operations, emissions, and compliance.

8. Crime and law enforcement data: Law enforcement agencies must report crime statistics, arrests, convictions, and other related information to the state.

9. Campaign finance information: Political candidates and committees are required to report campaign contributions, expenditures, and financial information to ensure transparency in the electoral process.

10. Economic and statistical data: Government agencies may also require reporting of economic indicators, employment statistics, housing data, population demographics, and other statistical information to monitor and plan state resources.

It is important to note that this list is not exhaustive and reporting requirements can vary depending on the specific sector, industry, organization, or individual circumstances. It is always advisable to consult with relevant California state authorities or seek professional guidance to ensure compliance with reporting obligations.

What is the penalty for the late filing of california state?

The penalty for late filing of California state taxes varies depending on the amount owed and the length of the delay in filing. Generally, if you fail to file your California state tax return on time, you may be subject to a penalty of 5 percent of the unpaid tax per month, up to a maximum of 25 percent. Additionally, if you fail to pay the tax owed, you may also be subject to a separate penalty of 0.5 percent per month, up to a maximum of 25 percent. It's worth noting that these penalties can be avoided or reduced if you can demonstrate reasonable cause for the delay.

Can I create an electronic signature for the subpoena oah form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your california state county form.

How do I edit you oah form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share california los from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I fill out 09 california on an Android device?

Use the pdfFiller mobile app and complete your subpoena oah your form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your subpoena oah form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

You Oah Form is not the form you're looking for?Search for another form here.

Keywords relevant to you oah search form

Related to you oah latest

If you believe that this page should be taken down, please follow our DMCA take down process

here

.